SBLV Capital Group

Advanced Solutions for Automated Trading and Financial Market Investments.

Advanced Solutions for Automated Trading and Financial Market Investments.

At SBLV Capital Group, we revolutionize financial trading with cutting-edge algorithms. Utilizing advanced mathematical precision and real-time data analysis, we continuously optimize our strategies to adapt to market changes and deliver superior performance. Our goal is to set new standards in financial investments and help our clients achieve unparalleled success.

Transforming Innovative Ideas into High-Performance Trading Strategies

Optimizing Growth by Integrating Advanced AI and Mathematical Models

Providing Tailored Algorithmic Solutions Based on Investor Risk Profiles with Predefined Investment Plans

Our algorithms use historical data and mathematical patterns to develop high performing trading strategies. It constantly optimizes and learns from new data to improve accuracy.

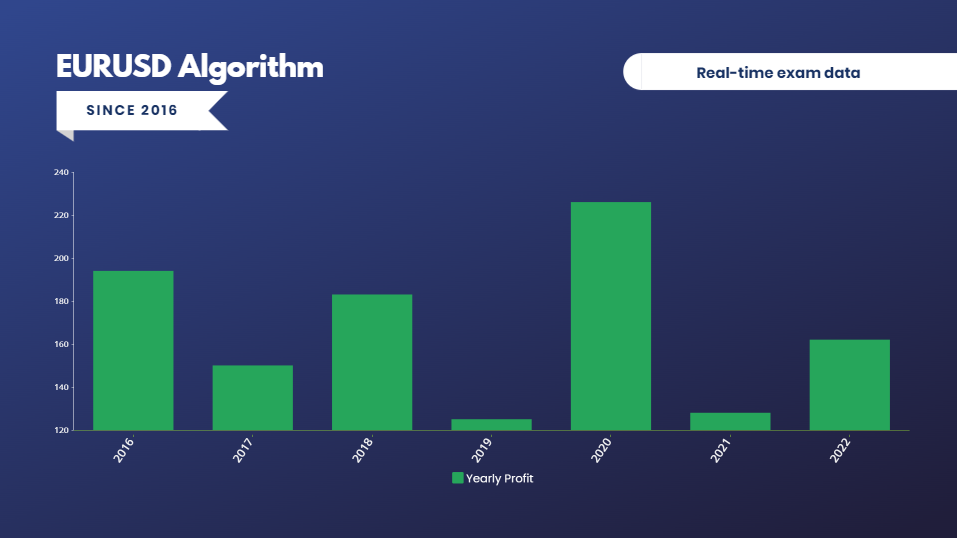

The rest of the statistics(1% risk per trade):

Our trading strategy has a winrate of 67.4%, averaging 48 trades per month and 2.175 trades per day. The average commission is 0.036 times your risk; for a $1,000 risk per trade, the commission averages $36. The deepest drawdown is 17.3%, with the longest drawdown lasting 105 trades (about 48 trading days or 70 calendar days). Average loss per trade is -1.00%, average win is +0.96%, and average trade gain after fees is +0.27%. This results in an average monthly return of +14%.

The rest of the statistics:

On December 26, 2023, we finalized the GBPUSD Hybrid 1.0 strategy. The longest drawdown was 37 trades (16 trading days or 24 calendar days) and the deepest drawdown reached 11.6 times your risk. With a win percentage of 66.61%, the strategy made 1,177 trades, averaging 2.25 trades per day. The total yield is 493.55 times your risk. Each trade yields an average of 0.4193 times your risk, with winners averaging 1.1357 times your risk. The average commission is 0.034 times your risk, and the advised risk range per trade is 1.00% to 4.00%.

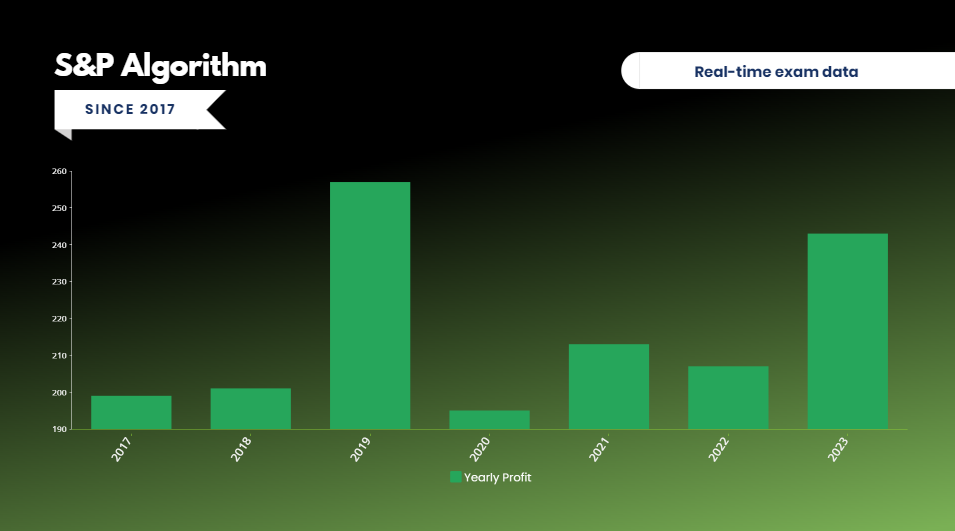

The rest of the statistics:

S&P Hybrid 4.0: The longest drawdown was 45 trades (approximately 22 trading days or 30 calendar days), and the deepest drawdown reached 12.3 times your risk. With a win percentage of 68.5%, the strategy executed 980 trades, averaging 1.5 trades per day. The total return is 450.75 times your risk. Each trade yields an average of 0.462 times your risk, with winning trades averaging 1.250 times your risk. The average commission is 0.024 times your risk, and the recommended risk range per trade is 1.00% to 3.00%.

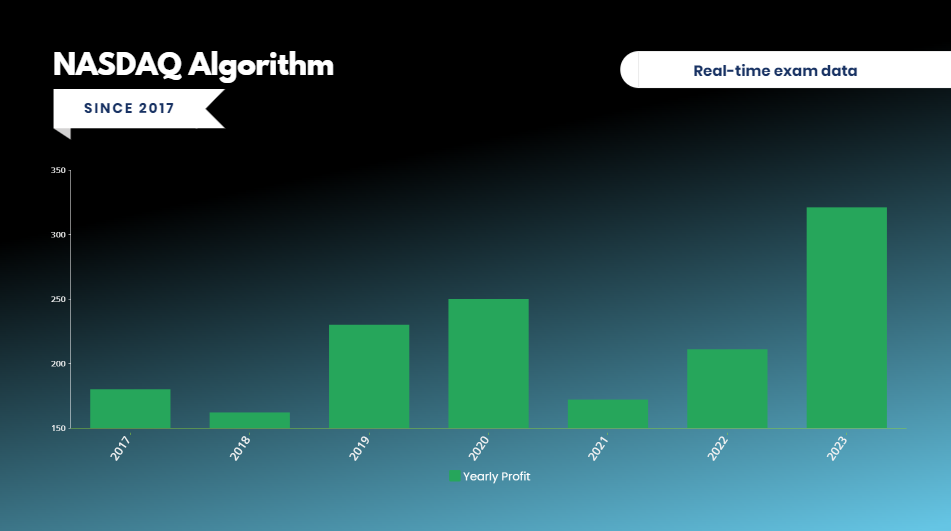

The rest of the statistics:

NASDAQ Hybrid 2.0. The longest draw was 62 trades (30 trading days or 41 calendar days) and the deepest draw came in at 14.6 times your risk. With a win percentage of 71.31%, the strategy executed 1,053 trades, an average of 2.05 trades per day. The total return is 536.22 times your risk. Each trade pays an average of 0.50923 times your risk, with winners averaging 1.3357 times your risk. The average commission is 0.022 times your risk, and the recommended risk range for trading is 1.00% to 4.00%.

Our team has experience in the world of commerce, mathematics and data science, combined with over 6 years of experience.

In the dynamic landscape of technology and innovation, one term has been resonating louder than ever: Web3. As the digital realm continues to evolve, ushering in a new era of decentralized applications, blockchain technologies, and digital assets, the potential for groundbreaking disruption is immense. At the forefront of this revolution stands TGE Ventures, a visionary venture capital and incubation fund dedicated to catalyzing the growth of Web3 ventures.